When you are buying a property in St Albans, it’s important to remember that Stamp Duty Land Tax (SDLT) can add a significant amount to the final bill.

At the height of the pandemic, the Stamp Duty holiday proved popular with homebuyers, triggering a boom in property sales. Unfortunately, the discount ended last year, but you can use a Stamp Duty Calculator for 2022 to discover how much tax you can expect to pay now.

Stamp Duty Calculator

Use our stamp duty calculator to get to know potential stamp duty costs. These calculators are for general interest and must not be relied on.

What is Stamp Duty Land Tax?

Stamp Duty is a tax that you must pay when you buy a residential property in England, Wales or Northern Ireland worth £125,000 or more. The amount you will pay is based on the agreed sale price (not the asking price).

The Stamp Duty surcharge becomes payable when:

- You purchase a freehold property

- You buy a new (or existing) leasehold

- You purchase a home through a shared ownership scheme

- When land or property is transferred to you in exchange for payment, for example, if you take on a mortgage or acquire a share in a house or apartment.

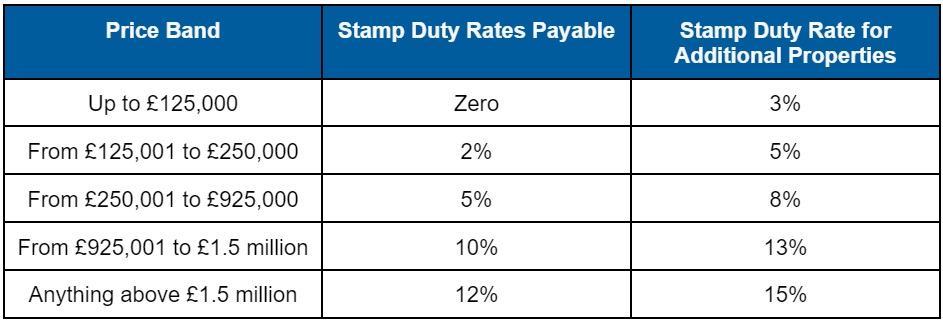

SDLT is a progressive tax, which means that the percentage of money payable rises incrementally with each price band. See the chart below for a summary of residential price bands. Alternatively, pick up any sales listing on our website to use our Stamp Duty Calculator for 2022.

How do I pay SDLT?

When you buy a property you must send your SDLT return to HMRC and pay the money due within 14 days of completion. Your solicitor or conveyancer will usually file the return and pay the tax on the day of completion (the amount is then added to their fees).

If you are eligible for SDLT relief (for instance, as a first-time buyer) they will claim that for you at the same time.

Are there any exemptions?

If you are buying a caravan, mobile home, houseboat or property costing less than £40,000, no Stamp Duty is payable. If you are a first time buyer purchasing a residential property, you will pay no SDLT up to £300,000 and only 5% SDLT on the portion between £300,001 and £500,000.

Will I pay more Stamp Duty on a second home?

If you are buying a second home or a buy-to-let property, you will pay a higher rate of SDLT. On an additional property, you’ll pay a stamp duty rate of 3 % on top of the rates shown above.

However, the stamp duty surcharge on a second home doesn’t apply if your ownership of two properties is temporary. For example, if you buy a property destined to be your main residence before selling your old home, you could find yourself owning two properties at once. Fortunately, claiming stamp duty back on your second home is relatively easy.

To avoid additional property stamp duty, you will need to sell your old property within 36 months (three years). HMRC will grant a longer period for the sale to go through if a) if the pandemic has caused delays or b) if local authority action halted the sale.

In all other circumstances, you will need to factor in the additional 3 per cent surcharge when budgeting to buy another property that is not your main home.

SDLT and the family

Divorce: In divorce cases where one partner wants to stay in the family home, shares of the property can be transferred from one partner to the other without SDLT becoming payable (this must happen further to a court order or as part of an official agreement).

Buying for a child: Providing property for your offspring may be a generous gesture, but you will still be required to pay Stamp Duty. If you already own a property, you’ll pay the 3 % second home surcharge.

Inheritance: The good news is, you don’t have to pay Stamp Duty on an inherited property. However, if you take on some or all of an existing mortgage on the property, you could be charged SDLT on the value of the mortgage, over the relevant SDLT threshold.

Buying in St Albans

If you are looking for a second home or buy-to-let investment in St Albans or the wider area and you would like some help with your search, why not give us a call? As the best Estate Agents in St Albans with a history dating back to 1825, we will use our extensive local knowledge and established networks to find you the perfect property.